This Financial App Will Help You Get In Touch With Your Feelings

Joy

You might not realize it, but your spending and saving habits can take a toll on your emotions. That $30 parking ticket you had to pay? Ick. That $3 glass of wine you got during happy hour with friends? Sweet.

It’s these types of emotional reactions to money that financial app Joy is capitalizing on. This money app was released in fall 2017 and has since garnered attention from outlets such as CNBC, Glamour and The Wall Street Journal. With reviews stating that Joy helps users create a healthier relationship between them and their money, that our cash can actually make us feel something and that it’s the “Tinder for your bank account,” we decided to test it out ourselves.

Before you download Joy, know the basics:

- It’s free, but only available on iOS, though an Android version will be released in the near future.

- It’s only available in the United States right now.

- You’ll need to connect your bank account to get the most out of the app experience.

- All major U.S. banks, plus 20,000 other banks, credit unions and credit card companies sync with the app.

- The main features of the app include rating your charges as “happy spends” or “sad spends,” comparing your spends month over month, saving money daily to the joy savings account and working with your virtual money coach to increase positive financial behavior.

Joy is user-friendly and fun.

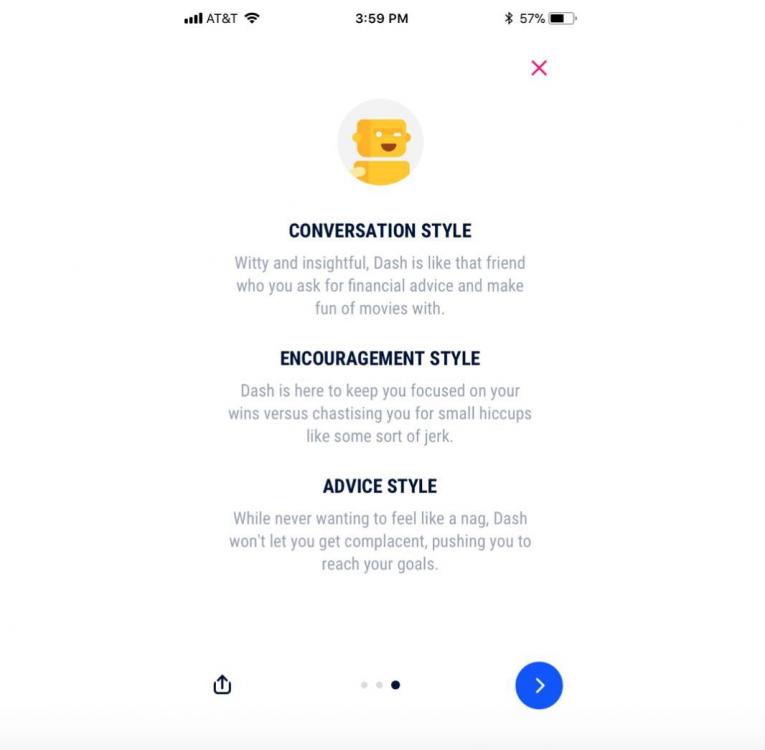

When you first download Joy to your iPhone, you’ll be welcomed by bright colors, funny GIFs, witty quotes and more. After linking your phone number and email address, you’ll be walked through a series of questions that focus on your financial goals, spending and saving habits, money interests and more. You’ll then be categorized as a certain type of saver/spender before meeting your Joy money coach (for instance, I’m a “Rock”).

If this sounds like a lot of work, think again. The experience is super intuitive and you’ll feel like you’re texting with a best friend the entire time, with pre-loaded responses for you to easily click.

Once you’re done, you’ll be prompted to finish a few more details for your profile (like your birthday) and then you can start connecting your bank and credit card accounts. Joy has all of the banks and credit card companies loaded in the app so all you have to do is find yours and sign in with your online username and password. The app will then sync those spending accounts so that you can start the fun part.

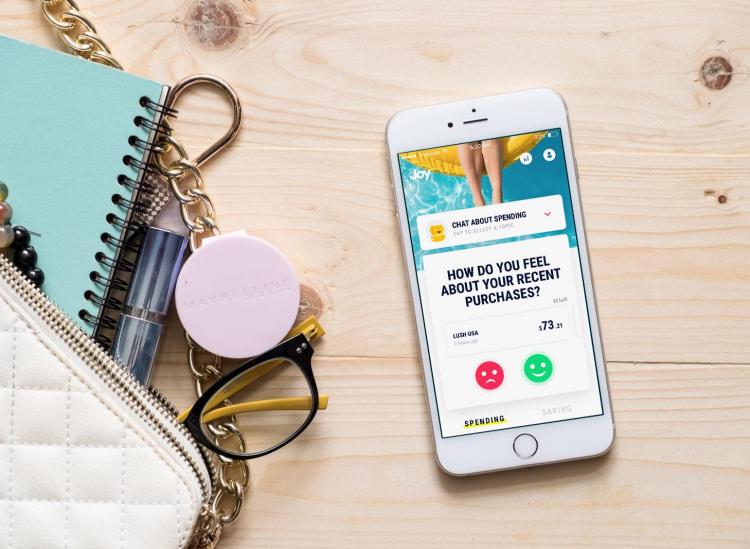

Swirled/Hilarey Wojtowicz

Rating your happy and sad spends could help you save.

Now that everything is synced in the app, you can start rating your purchases and expenses that show up in your checking and credit card accounts as either “happy spends” or “sad spends.” The app shows you the dollar amount and what you spent that money on, and then gives you a red sad face option and green happy face option. After you rate the spend by clicking on one of the sad faces, you’ll be prompted with the next one. This continues until you’ve rated every spend in your accounts that you have linked to the app.

Once you’ve rated all of your spends, you’ll get some info on the total happy vs. sad spends over the last month, as well as how much you’ve spent or saved month over month. For instance, I linked my checking account and my one main credit card account. After rating all of my expenses (like my mortgage, monthly train pass, investments, Ubers, coffee and more), I was told that on average I have 23 happy spends and seven sad spends per month.

Note: It may take up to four hours for a new spend to appear in your Joy app.

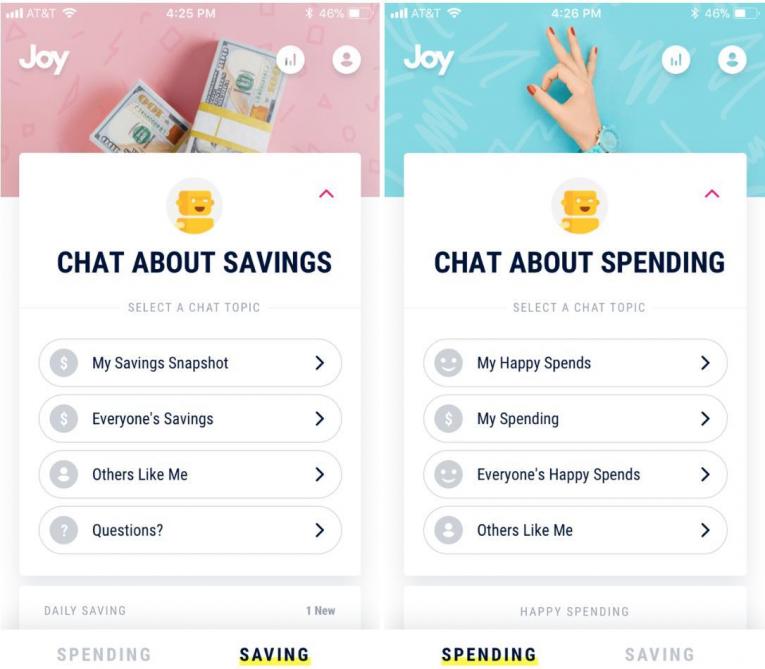

Additionally, you can “chat” with your virtual money coach about your spending and saving habits. Just click on one of the two tabs at the bottom of the screen and you’ll be able to learn about your specific spending and saving habits, the savings habits of others, the happy spends of others, plus general comparisons of other users in the same spender/saver category (i.e. other “Rocks.”) You can also ask questions, though the pre-loaded options are a little limiting. Overall, your money coach will give you interesting insights that may help you make more positive financial decisions every day and week.

Swirled/Hilarey Wojtowicz

You can save money more often through Joy.

Beyond rating your spends, the Joy app also offers users a savings account that allows you to save money at literally the push of a button. (Seriously, could it get any easier?)

The Joy savings account links directly to your synced bank account in the app. It’s an account with Bank of Internet USA that’s FDIC-insured for up to $250,000, too, and promises to never overdraft from your account. All you have to do is opt in to the savings account and then every day you’ll be asked if you want to save a certain amount. The app will use the data it has on your spends and account balances to determine the perfect amount that you can stash away that day.

For example, on the first day, I was asked if I wanted to save $1.42, and on the second day I was asked if I wanted to save $2.80. It seemed like such a small amount, but I can definitely see how saving that little bit every day could pay off in the future.

You can choose an alternative amount though if you want to save even more, though you can’t save more than $5,000 per day (if you’re doing that, though, props to you). Additionally, you can withdraw money from the account easily (also up to $5,000), sending it back to your regular bank account at any time.

Note: The Joy savings account doesn’t currently offer any interest rates, so saving it there won’t make you any additional money. Joy totally recognizes this and isn’t shy from suggesting on its website that users can and should save money in a better account where they can watch it grow, only using the Joy account as a place for secondary savings right now.

Consider Joy as the way to monitor your spending.

At the end of the day, there’s not a lot that you can do with the Joy app beyond rating your spends and saving small amounts of money every day. However, the app is great for users who aren’t in tune with their spending habits. Monitoring how much you spend is the first step in taking inventory of your finances. Joy helps you recognize how much you spend every day and month, connecting it all with your feelings and emotions so that you can improve your overall financial behaviors. With an app like this, you can manage your money like a boss and feel some real joy out of your finances.

Have you downloaded the Joy app? Let us know what you think of it, plus any others you would recommend, in our LinkedIn Group!

RELATED

5 Financial Planning Apps That Will Help You Save Money

5 Smart Budgeting Apps That Will Help You Keep Your Life Together

5 Cool Side Hustle Apps That Could Make You Some Extra Cash