This Financial App Makes Money Management Crystal Clear

Clarity Money

Between Netflix, Hulu, Spotify and our other favorite services, there are just so many subscriptions to sign up for these days, which is why it’s not surprising that you might forget about one or two down the road. After all, do you really notice that $8 charge on your credit card every month?

Well, that recurring $8 payment can add up over time. So if you’re not using that subscription, shouldn’t you just unsubscribe? Now there’s an app that can help do it for you, while also making you more aware of your budget in general. Clarity Money is all about using technology to make your personal finances more transparent than ever. It also makes it super easy to save money in a high-yield savings account, track your spending, pay down debt, boost your credit score and more.

As with many of the financial apps out there, some just seem too good to be true. So we tested it out ourselves, and here’s what we found.

Before you download Clarity Money, know the basics.

- It’s free and available on both iOS and Android operating systems.

- Clarity Money is owned by Goldman Sachs.

- Only United States financial institutions can be linked to a Clarity Money account.

- You’ll need to connect all of your bank accounts and credit cards to get the most out of the app.

- The main features of the app include tracking spending and subscription services, saving money in a high-yield savings account, checking your credit score and suggesting credit cards and ways to improve your budgeting.

Clarity Money is super clear.

Clarity Money

We downloaded Clarity Money and connected a bank account in just a few minutes — it was incredibly easy. Clarity Money’s dashboard is also very intuitive and welcoming.

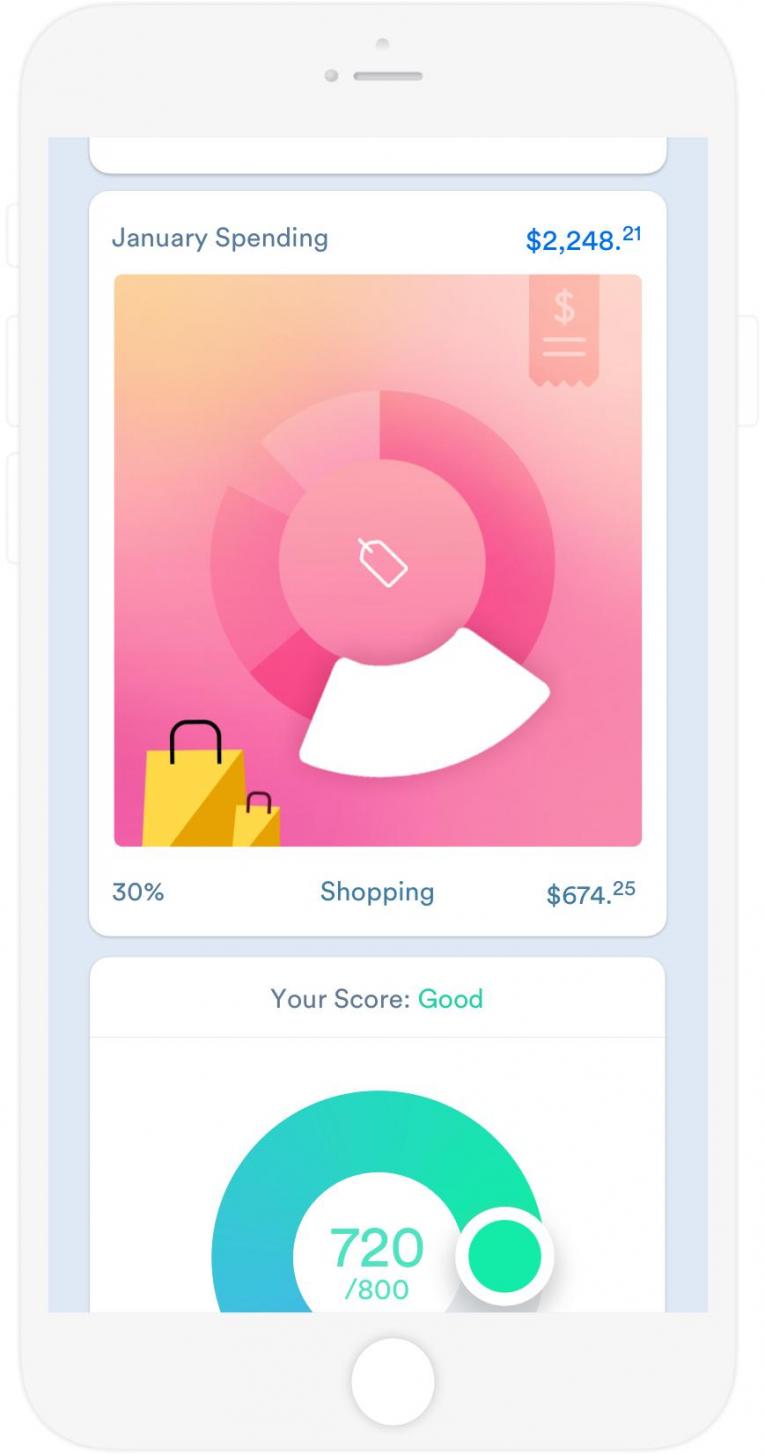

As you scroll down, the app shows you:

- How much cash and credit debt you have

- How much you spent in the last few days

- All of your transactions and your monthly income to date

- A countdown clock to your next payday

- A breakdown of how much of your income you already spent that month and how much is left

- A suggestion for saving a few bucks per week in an account for the future

- A roundup of what you spent money on most often that month

- A breakdown of your spending per category (transportation, food, bills, etc.)

- A suggestion for investing spare change in an Acorns account

- A graph of your recurring expenses

- A list of monthly subscriptions that you can cancel with just a click

- Your credit score

- Your credit cards

- Your credit usage

We can’t believe how much information Clarity Money packs into its dashboard, all available via one page and a lot of scrolling. But it feels very natural and user-friendly, with bright colors, cute piggy banks and inspiring quotes.

It breaks down your spending in more than one way.

We love that the Clarity Money app breaks down your spending in a multitude of ways. Not only does it give you the lump sum, but it shows you your individual transactions, the various categories in which you spent, what you spend money on most often every month and recurring expenses. We have yet to see this type of breakdown on other personal finance apps.

Another cool component is the ability to search transactions right within the app. By clicking on the small magnifying glass icon on the bottom navigation bar, you’re taken to a list of all of your transactions related to the accounts that are connected within the app. They’re even broken down by date and are very up to date. We saw a transaction that was made less than three hours earlier on the list when we tested out the app.

Pro Tip: Clarity Money is a great app to use when you want to check on all of your financial information, such as ensuring that there haven’t been any abnormal charges made to your accounts. Check your transactions page often to make sure you’re never the victim of unauthorized charges.

You can save and earn more money.

Clarity Money

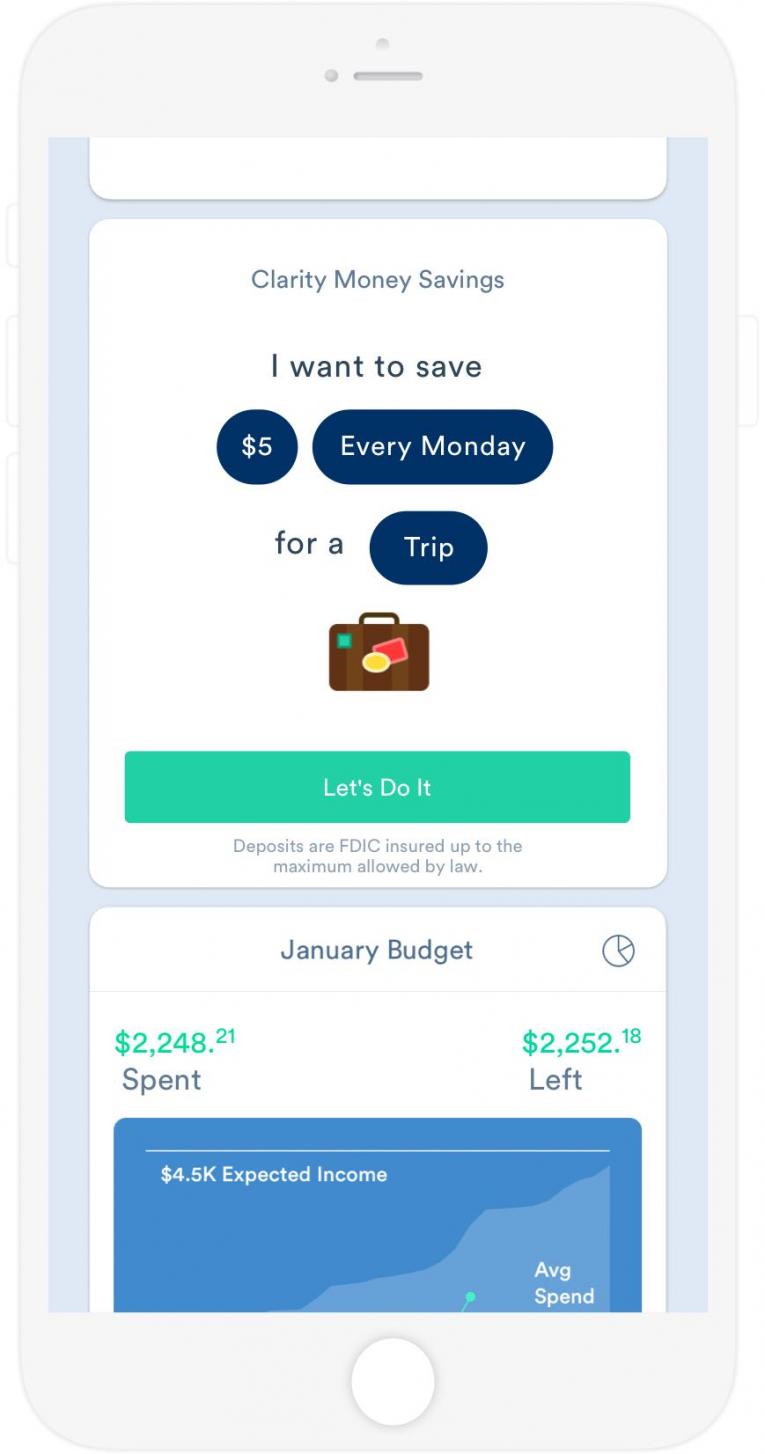

The best way to have your money do some of the work for you is by saving it in a high-yield savings account. A higher interest rate will help you earn more money on the balance you have saved in the account. Higher interest rates are often offered via online banks, while traditional brick-and-mortar banks offer an average interest rate of just 0.04 percent. With Clarity Money, you can easily sign up for a savings account with Marcus by Goldman Sachs.

Marcus by Goldman Sachs is an online savings account with a 1.90 percent APY. Clarity Money makes it super easy to select the amount of money you want to save (up to $1,000), when you want to save it (weekly or monthly), what you want to save it for (choose from several life events) and where you want to pull the funds from.

For example, you can choose to save $5 weekly on Thursdays for a new car, with the funds being transferred from your checking account that’s linked in the app. Or you could choose to save $100 every month on the 20th for a vacation with the funds transferred from your savings account that’s linked in the app. Whatever you choose to save in this account, you’ll earn a pretty penny in interest per year. If you had $1,000 in the account by the end of the year, and depending on how often the interest is compounded, you could earn around $19 per year on that money. And it’s all through just a few clicks in the app!

You can start investing, refinance your student loans and get affordable renters or homeowners insurance.

Clarity Money makes it easy to sign up for Acorns, an investment app, SoFi, a student loan refinancing company, and Lemonade Insurance, which offers affordable renters and homeowners insurance. The app already knows what you’re spending money on, so it’s able to suggest these ways that you can save or grow your money. Instead of needing to create several separate accounts, the app helps you do it in a streamlined way. Once you have these additional accounts, you can link them to the Clarity Money app to keep track of that money, too.

Clarity Money makes managing money easy. It didn’t feel as shocking as Mint, which we appreciated. It feels like it eases you into your money as you scroll down the dashboard, which we found really enjoyable. Plus, it offers more than just money management — we love that it suggested ways to save, invest and refinance.

Overall, it’s pretty clear to us that Clarity Money deserves a spot on your phone. Have you ever tried Clarity Money? Let us know in our LinkedIn Group!

RELATED

This Financial App Makes Investing In Real Estate Insanely Easy And Affordable

10 Financial Planning Apps That Will Help You Save Money

This Financial App Will Help You Get In Touch With Your Feelings