This Financial App Helps You Easily Invest Your Spare Change Every Day

Acorns

Investing money can often seem intimidating. Many think you need to have a good chunk of change in order to start. But in reality, you just need a little bit of change. We’re talking just one penny. At least, that’s all you need with Acorns.

The Acorns app is the investing app that helps you put your spare change to work for your future. Whether you’re saving for a house or retirement, Acorns can help you do both every day with its micro-investing strategy. Plus, it’s super affordable (and free for college students). Investing money has never seemed this simple and easy, so we decided to test it out for ourselves. Here’s what we found.

Before you download Acorns, know the basics.

- It’s available for both iOS and Android operating systems.

- It’s free for college students and costs just $1, $2 or $3 for everyone else investing up to $1 million, depending on the plan you choose.

- There are three plans from which to choose, so you can keep it simple, invest for your retirement or sign up for both an investment account and a checking account to really streamline your finances.

- Acorns connects to your bank account so that every time you spend money, the amount is rounded up to the nearest dollar. That additional amount is then automatically dropped into your Acorns account.

- The money is then invested across a diverse portfolio of Exchange Traded Funds (ETFs), which are made up of stocks and bonds ranging from large companies to real estate.

- There are five levels of investing, depending on your comfort level: conservative, moderately conservative, moderate, moderately aggressive and aggressive.

- Your investments are managed by robo-advisors, but there are human advisors on call if you need help with anything.

Pick your plan and start investing.

Acorns

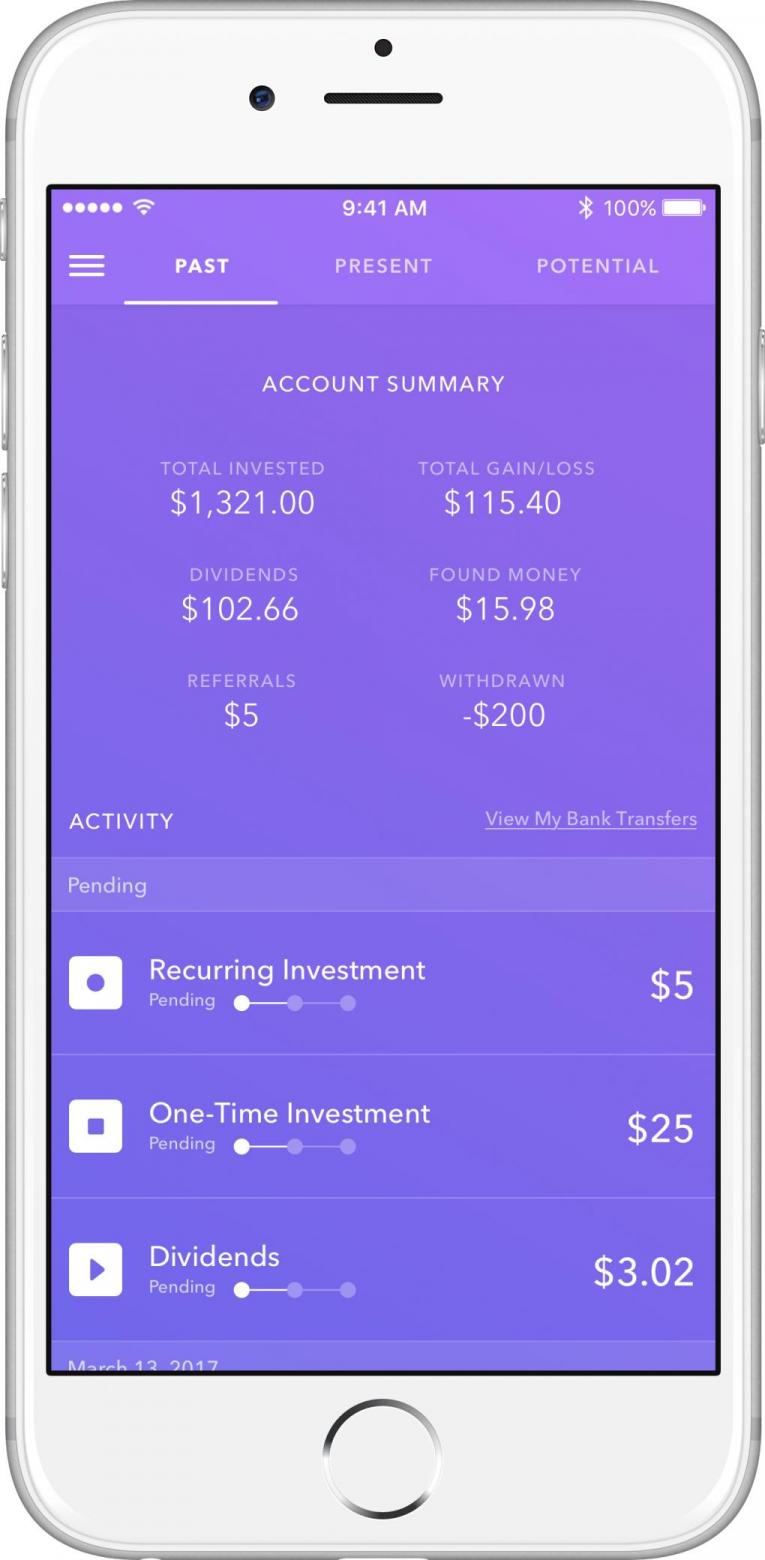

The Acorns app offers three plans for investing, each for a different monthly price. We decided to test out the Acorns Core plan, which is free for college students and just $1 for everyone else up to $1 million invested. This plan is the original round-up plan where you can invest all of your spare change from everyday purchases. You can also set it and forget it by opting into the recurring investment strategy where you can invest as little as $5 per week. If you don’t want to do a weekly investment, you can choose to invest a lump sum instead. However, there’s no minimum investment required.

To get started with the Acorns Core plan, just download the app and follow the setup instructions. Acorns will ask you for a lot of personal information, including your address, phone number, social security number, employment status, income and net worth. Once that’s done, you’ll connect your bank account and select the recurring investment of your choice (though you can also waive it at this time and set it up later). Then you’ll get a personalized portfolio based on all of your information which will be split between stocks and bonds. Lastly, you’ll be asked to sign your certificate, which makes it all official. Now you’re ready to automatically invest your spare change.

The other two plans are Acorns Core + Acorns Later, which is $2 per month, and then Acorns Core + Acorns Later + Acorns Spend, which is $3 per month.

Acorns Core + Acorns Later offers everything from the Acorns Core investment portfolio plan, plus an Acorns Later account, which is geared toward long-term, retirement investing. Acorns will help you roll over any other retirement accounts you might already have and will suggest the best type of IRA for your financial situation and goals.

Acorns Core + Acorns Later + Acorns Spend offers everything from the $2 plan, but also gives you access to a special Acorns checking account for just $1 per month. Acorns Spend is all about the real-time round-ups so that you can save and invest more money every month without really feeling it. The checking account offers a debit card for unlimited free and fee-reimbursed ATMs around the United States, plus digital direct deposit, mobile check deposit, free bank-to-bank transfers and no overdraft or minimum balance fees. The account is FDIC-insured for up to $250,000 and has built-in fraud protection.

Acorns Found Money helps you spend smarter.

Acorns

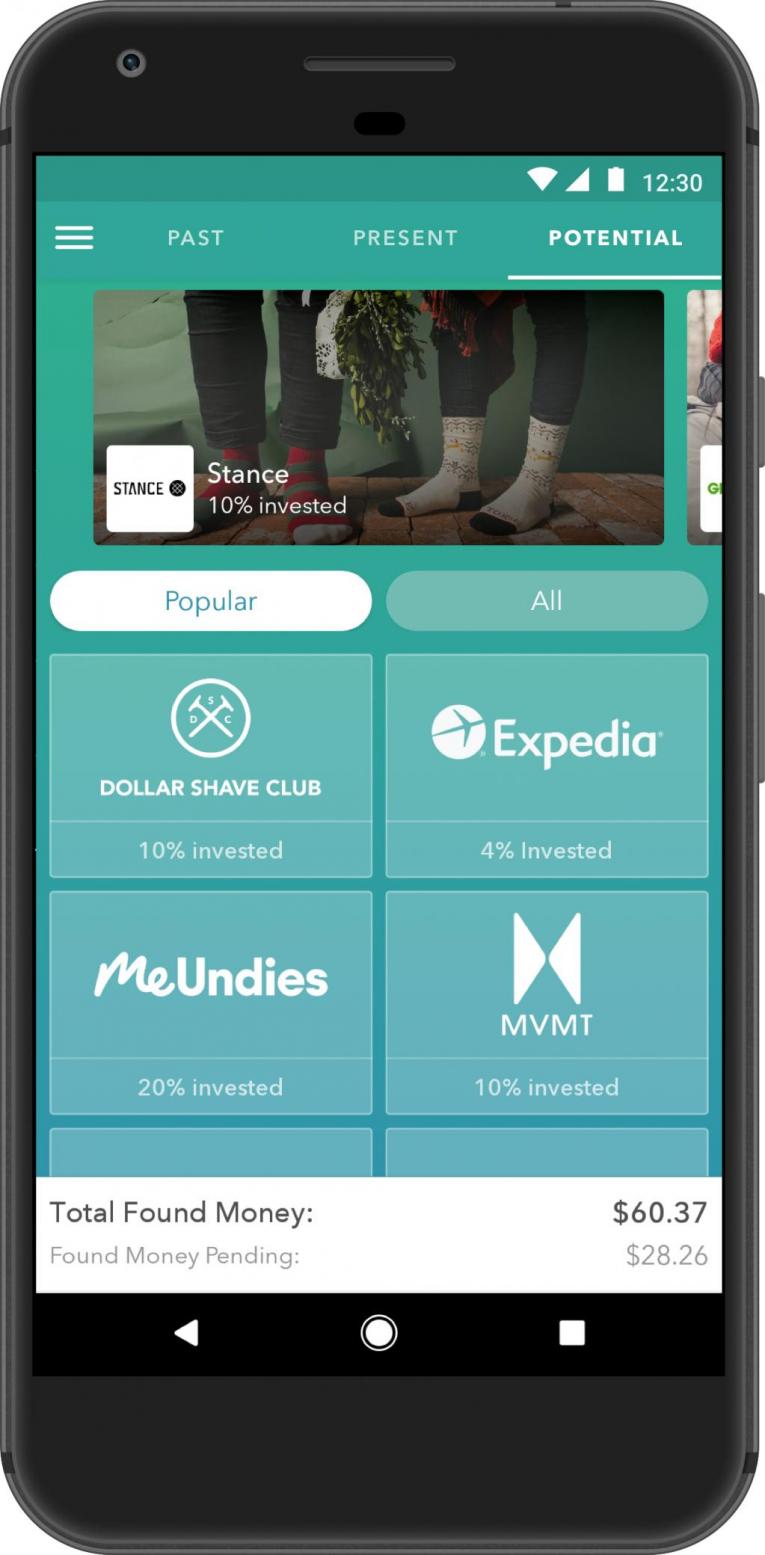

Acorns partners with over 200 brands to help you earn “cash back” on your purchases so you can save and invest more money. The Found Money feature does cash back in a new way, calling it “cash forward.” When you spend money with one of the partners, such as Lyft, Apple and Airbnb, you can earn a percentage back from the company, which is then transferred directly into your investment account. All you have to do is link your debit card or credit card to your Acorns app and use those cards when shopping at these retailers. You can then track your Found Money to see how much you’ve spent and invested over time. The money will appear in your account between 60 and 120 days of your purchase.

Pro Tip: Found Money also has a Chrome extension so that you can keep the money flowing into your account while using a desktop browser, too. It’s free to use as long as you have an Acorns account.

Acorns is great for new investors.

If you’re new to investing, start with an Acorns account. Its micro-investing strategy is simple and easy — you’ll literally be stashing spare change into an investment account on a daily basis. Think about it: If you buy coffee every morning for $2.50, you’ll be investing 50 cents per day into your Acorns account, which is $3.50 over the course of seven days, or about $15 per month, or about $180 per year!

And you’re not just saving that change — that money has the potential to grow over time. By the end of the year, you could earn an additional $10 just by putting money into your investment account. It really can’t get any easier.

There are a ton of great apps out there for investing, but we’re fans of Acorns and its simplicity. Don’t miss out on letting your money do some of the work for you. Start investing it now so that you can live the life you’ve always wanted later.

RELATED

This Financial App Makes Investing In Real Estate Insanely Easy And Affordable

5 Things You Should Know Before You Invest

This Financial App Makes Money Management Crystal Clear